Madison Investing Launches Free Blueprint Course for Passive Investors

Investors bought a record number of investment properties in 2021, enticed by the possibility of the outsized returns that real estate often delivers. It’s common for both novice and experienced investors to purchase single-family properties and remain active or semi-active in the management of those investments.

There are other opportunities to invest in real estate that are less well-known but often more attractive and less hands-on for investors who take advantage of them.

Madison Investing has launched a new email course called Your Blueprint for Passive Real Estate Investing. This course walks aspiring investors through different types of real estate investing — ranging from active investments like self-managed rental properties to passive investments like syndications.

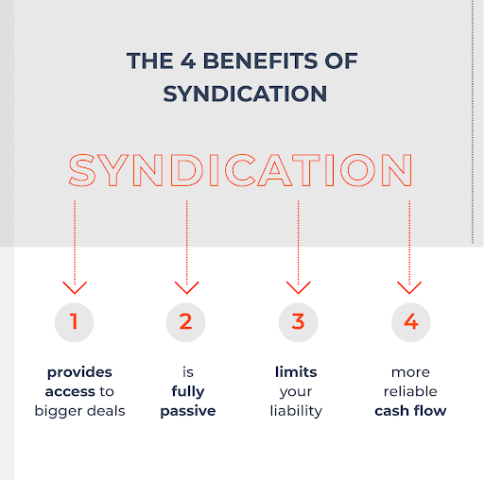

The course also educates participants on fully passive investment strategies like real estate syndication. Syndication, while lesser known than more traditional investments, is growing in popularity because it delivers a series of major benefits that are difficult to replicate in smaller, more traditional strategies:

– Access to bigger deals: Most investors can’t afford to spend millions of dollars on a multifamily apartment building or self-storage facility. But, through syndication, someone can invest $50,000 (or a similar amount) as part of a pool of other investors to gain access to these bigger deals.

– A truly passive investment opportunity: Investors in real estate syndications are Limited Partners, which means they contribute only capital. They have no obligation to handle any management tasks.

– Limited liability: Someone who purchases a single-family home and rents it out may be liable for accidents and other incidents that occur at the property. There’s limited liability when an investor chooses to participate in a real estate syndication.

Not all real estate syndications are created equal, though. Investors should look for and participate in syndications run by experienced operators that have track records of finding great deals and executing business plans that deliver strong returns for Limited Partners, time-after-time.

Quality deals with sponsors have specific characteristics, including:

– A track record of success: The best sponsors have worked on successful projects, and they regularly put their own money into deals.

– A proven approach: Due diligence and contingency planning are essential to the approaches of the best sponsors.

– An experienced team: Successful sponsors know the roles and responsibilities that will be most effective at driving results.

– Solid communication: Proactive, modern, timely and detailed communication is a hallmark of the best sponsors.

– Strong values: Tenants are more than just numbers — they are priorities to the best Sponsors.

Madison Investing has a track record of identifying great sponsors that consistently put together strong deals. Since 2018, Madison Investing has launched and exited 13 different syndication and fund deals that averaged an exit of less than three years and a 72% return for Investors.

“At Madison Investing, we serve a mission of providing investors with time, which is their most valuable asset,” said Madison Investing CEO Spencer Hilligoss. “This course is helpful in fulfilling that mission and pursuing the higher purpose of democratizing access to private real estate deals.”

The philosophies, approaches and best practices that generated those returns for investors are now available to anyone who signs up for Your Blueprint for Passive Real Estate Investing. Sign up for the seven-installment course to get in-depth information on:

1. The basics of real estate investing.

2. Setting investment goals.

3. Choosing the right investment strategy.

4. Real estate syndication and its benefits.

5. Good deals vs. bad deals.

6. What investors are eligible for.

7. How to take the next step.

The course starts immediately upon signup, with each new day providing a deep dive and key insights into the seven topics listed above. Sign up to start Your Blueprint for Passive Real Estate Investing today.

About Madison Investing

Madison Investing is on a mission to provide investors with the single most important asset: Time. They provide their exclusive investment community bespoke, vetted real estate investment opportunities, with the goal of accelerating investors’ trajectory toward financial independence.

Securities Disclaimer: Past performance is not a guarantee of future results. Investing in real estate, while capable of producing attractive returns, can also be highly volatile, and is suitable for experienced, accredited investors. Investing in real estate is generally illiquid and may not be easily sold. Securities offered through Finalis Securities LLC Member FINRA/SIPC. Madison Investing and Finalis Securities LLC are separate, unaffiliated entities.

Media Contact

Company Name: Madison Investing

Contact Person: Catherine Mendez

Email: Send Email

Country: United States

Website: https://www.madisoninvesting.com/