Garment Interlining Market Size, Share, Analysis And Forecast To 2031

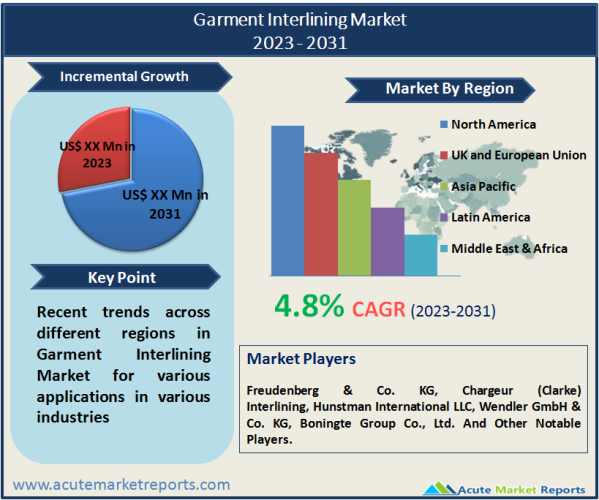

The market for garment interlining is anticipated to expand at a 4.8% CAGR between 2023 and 2031. The interlining of a garment is a layer of material inserted between the outer fabric and the lining to improve the garment’s structure, shape, and performance. It provides garments with support, shape retention, and durability, resulting in a well-defined silhouette and enhanced aesthetics. The demand for garment interlining is predominantly driven by the increasing fashion awareness of consumers, their rising disposable incomes, and the rising demand for high-quality, well-finished garments. The revenue growth of the market can be attributed to factors such as the expansion of the fashion and apparel industry, the rising demand for premium and customized garments, and the rising preference for high-quality fabrics and materials. Menswear, womenswear, childrenswear, athleisure, and formalwear are just some of the segments of the fashion and apparel industry where garment interlining is utilized. Suits, shirts, dresses, blouses, jackets, and vests make extensive use of this material. The increasing prominence of functional and performance-oriented garments that require additional support and reinforcement also drives the demand for garment interlining.

Increasing demand for garments with improved aesthetics and functionality is one of the primary forces propelling the garment interlining market. Consumers are pursuing garments that not only look good but also provide superior comfort and longevity. The interlining of garments plays a crucial role in attaining these desired characteristics by enhancing the garments’ structure, shape, and overall appearance. It aids in preserving the garment’s shape, prevents creasing, and provides a sleek, well-defined silhouette. This driver is supported by the rise in fashion trends and the increasing demand for high-quality apparel. Consumer preferences and fashion industry trends emphasize the importance of improved garment aesthetics and functionality. The demand for garments with impeccable fit, structure, and durability is highlighted by fashion magazines, runway shows, and social media platforms. Additionally, consumer evaluations and feedback emphasize the significance of well-constructed, aesthetically appealing garments.

The expansion of the global fashion and apparel market has a substantial impact on the garment interlining market. With a growing population, higher disposable incomes, and ever-changing fashion patterns, the demand for clothing continues to rise. As a result, garment manufacturers strive ceaselessly to produce high-quality, well-finished garments that satisfy consumer expectations. The importance of garment interlining in attaining these quality standards drives the demand for interlining products. The expansion of the fashion and apparel industry is supported by market reports, industry trade fairs, and retail sales data. The increasing number of fashion brands, retail stores, and online platforms that appeal to a variety of consumer preferences underscores the expansion of the industry.

Browse for the report at: https://www.acutemarketreports.com/report/garment-interlining-market

Technological advancements in garment interlining materials have contributed substantially to the market’s expansion. Manufacturers are continually innovating new materials with enhanced performance characteristics, such as enhanced permeability, moisture management, and stretchability. These developments allow garment manufacturers to produce garments with enhanced convenience, functionality, and aesthetic appeal. Additionally, technological advancements have led to the creation of eco-friendly and sustainable interlining materials, in accordance with the rising demand for sustainable fashion. The introduction of new interlining materials, including advanced synthetic fibers, innovative coating technologies, and eco-friendly alternatives, is evident from industry publications, press releases, and the introduction of new products by garment interlining manufacturers. In addition to consumer awareness and demand for sustainable fashion, eco-friendly interlining materials are being developed.

Fluctuating raw material prices are a significant restraint on the garment interlining market. Due to supply-demand dynamics, geopolitical events, and alterations in global trade policies, the prices of key raw materials used in the production of interlining, such as cotton, polyester, and synthetic fibers, are subject to market volatility. Manufacturers face challenges in terms of cost management, production planning, and pricing strategies due to fluctuating raw material prices. When the cost of primary materials increases, so do the overall production costs for manufacturers of garment interlining, which may result in higher prices for end consumers or reduced profit margins. In contrast, when the price of basic materials declines, manufacturers are under pressure to pass along the savings in order to maintain market competitiveness. This constraint requires manufacturers to closely monitor and manage the prices of raw materials, implement efficient supply chain strategies, and investigate alternative or hedging options to mitigate the impact of price fluctuations. In the global textile and apparel industry, fluctuating raw material prices have been observed. The impact of factors such as agricultural yields, oil prices, and trade policies on the prices of cotton, polyester, and synthetic fibers can be seen as examples of raw material price fluctuations in news articles and reports. In their financial reports and investor presentations, companies operating in the garment interlining industry frequently highlight the impact of raw material price volatility on their operations and profitability.

Various materials, including cotton, nylon, polyester, and wool, can be used to segment the garment interlining market. Among these segments, polyester interlining is anticipated to experience the highest CAGR between 2023 and 2031. Polyester interlining materials offer several benefits, including durability, resistance to wrinkling, low cost, and simplicity of care. These qualities make polyester interlining a popular option for a vast array of garments in various segments of the fashion and apparel industry. In addition, advancements in polyester technology have resulted in the creation of lightweight and breathable interlining materials, which has increased their popularity. In contrast, cotton interlining was the segment with the greatest revenue share in 2022. Cotton interlining materials are known for their natural, soft, and breathable qualities, making them suitable for a variety of garments, including both formal and casual attire. Cotton interlining is commonly used by high-end and luxury fashion manufacturers that place a premium on comfort and sustainability. The increasing demand for organic and eco-friendly materials in the fashion industry also contributes to the segment’s revenue. While significant, nylon, wool, and other material segments hold lesser market shares than polyester and cotton. Interlining materials made of nylon are utilized in sportswear and outerwear due to their durability, elasticity, and moisture-wicking properties. In cold-weather apparel, wool interlining materials are utilized for their insulation and warmth. The “others” category contains materials like viscose, silk, and composites that cater to specific needs or niche markets.

Access other popular reports https://www.acutemarketreports.com/category/retail-market

The garment interlining market can be segmented by its applications, which include coat interlining, outerwear plackets & jackets interlining, blazers interlining, and flame retardant interlining, among others. Among these segments, the segment for flame-resistant interlining is anticipated to experience the highest CAGR from 2023 to 2031. The purpose of flame retardant interlining materials is to provide fire resistance and meet safety standards in garments, especially in firefighting, oil and gas, and electrical utility industries. The stringent regulations and growing emphasis on workplace safety contribute to the high growth rate of flame retardant interlining materials. In contrast, in terms of revenue, the segment of coat interlining held the highest proportion in 2021. Numerous varieties of coats utilize interlining materials, which provide structure, warmth, and shape retention. Coats are a fashion industry staple, with demand encompassing a variety of climates and seasons. The demand for high-quality interlining materials in coats, including prestige and designer brands, contributes to the coat interlining segment’s revenue dominance. In terms of revenue, the outerwear plackets & jackets interlining and blazers interlining segments also hold significant proportions. These segments accommodate the particular needs of outerwear garments, such as reinforcement in plackets, lapels, and collars. Different consumer segments find outerwear and blazers appealing, varying from casual to formal wear. The “others” category consists of specialized applications or niche markets requiring interlining materials tailored to specific garment types, such as uniforms, uniforms for the armed forces, medical garments, and industrial attire.

Asia-Pacific dominated the garment interlining market in terms of revenue share in 2022. China, India, and Bangladesh are key contributors to the fashion and apparel industry in this region, which is a major manufacturing hub. Demand for garment interlining materials in the region is propelled by the presence of a large consumer base and a robust textile manufacturing infrastructure. In addition, Asia-Pacific countries benefit from low labor costs, which encourage international brands and retailers to outsource production to the region. As a result, Asia Pacific holds a substantial revenue share in the garment interlining market. On the other hand, Latin America is anticipated to have the highest CAGR during the forecast period of 2023 to 2031. The region’s expanding fashion industry, rising disposable incomes, and growing fashion awareness all contribute to the rising demand for high-quality garments and, consequently, garment interlining materials. Countries such as Brazil, Mexico, and Argentina are experiencing an increase in domestic and international fashion brands, resulting in an increased demand for interlining materials to meet rising consumer demands. In addition, Latin America’s proximity to the United States and its favorable trade agreements afford the region opportunities to export apparel to the North American market. The expansion of the fashion and apparel industry in nations such as the United Arab Emirates, Saudi Arabia, and South Africa is expected to fuel growth in the Middle East and Africa’s garment interlining market. However, compared to other regions, their revenue percentage is comparatively lower due to smaller market size and inferior manufacturing capabilities.

Get a Sample Copy From https://www.acutemarketreports.com/request-free-sample/139600

The garment interlining market is extremely competitive, with numerous key actors vying for market dominance. These competitors use a variety of strategies to differentiate themselves, increase their consumer base, and improve their product offerings. Freudenberg & Co. KG, Chargeur (Clarke) Interlining, Hunstman International LLC, Wendler GmbH & Co. KG, and Boningte Group Co., Ltd. are among the leading companies in the garment interlining market. Product innovation, customer-centric strategies, a focus on quality and dependability, technical expertise, customization options, sustainability initiatives, and strategic partnerships are some of the most important strategies employed by the leading participants in the garment interlining market. These strategies allow them to remain competitive and satisfy the industry’s diverse requirements. As players seek to capture market share and meet the evolving needs of the fashion industry, the market is anticipated to continue to be characterized by competition and innovation.

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com